–Trial version for review, May 2021 —

The UK FCDO’s 2020 Technical Competency Framework on Private Sector Development specified key competencies to guide PSD advisors’ recruitment and professional development (2023 version here); these pages signpost recommended reading structured according to the 2020 competencies. These pages have no official status and are offered by the DCED as a resource for the PSD community.

On this page, you will find pointers on PSD 4: Investment Climate Reform.

To send comments or suggested additions to the contents below, please contact the DCED Secretariat at Admin@enterprise-development.org.

Competency PSD4: Investment Climate Reform

The term ‘investment climate’ normally refers to the many factors that investors consider when choosing where to invest. Therefore, it includes (among others) the rule of law and degree of political stability, economic predictability, quality of infrastructure, and the regulation of financial, labour and energy markets (DCED, 2008; see also EBRD). Addressing some of these factors typically falls outside the normal donor remit.

The ‘complex of policy, legal, institutional, and regulatory conditions that govern business activities’ is a subset of the investment climate, and is generally referred to as the business environment. Thus, ‘business environment reform’ typically refers to the streamlining of those conditions, to make it easier to do business; see the DCED’s Knowledge page on Business Environment Reform for curated documentation on the theme.

Specific to FCDO, it may also be noted that by 2019, DFID was moving from a “rules and regulation” approach towards hybrid approaches involving both technical assistance and investments (BERF, 2019). Six approaches, with examples, are placed on a spectrum from the ‘traditional’ Investment Climate approach to ‘pure’ FDI; three illustrative case studies (Kenya, Rwanda and South Africa) are included.

Some use the term Investment Climate to refer to the business environment (e.g. BERF, 2019; LASER 2015; World Bank, 2014).

For a curated overview of donor work in Business Environment Reform, see the DCED Knowledge Page. Of particular interest is Development Initiatives 2018, which gives a survey of donor spending and links to other catalytic uses of aid for private sector development.For a short video introducing Business Environment Reform, see below.

4.1 Interpret and use a range of data, evidence and analytical frameworks to:

- describe how the investment climate affect the costs, risk and returns to investment by domestic and foreign businesses;

- describe the contextual (including infrastructure, energy and business services), legal, regulatory and administrative features of the investment climate.

For a listing and comparison of available datasets and scorecards on various aspects of the investment climate, see IFC 2016; it also itemises the gaps in indicator availability. For evidence of the causal link between investment climate (primarily business environment reform) and growth, see LASER 2015. The paper concludes that the overall evidence base linking investment climate improvements to growth is weak, for example relating to contract enforcement. Land rights were found to have a more convincing link, through a range of different mechanisms.

For a review of the impact of business environment reform on investment, see DFID 2015; the review considered 129 studies, 14 of which provided evidence that BER contributes to increased investment, leading to increased profit, value added and revenue. However, the size of the firm influences these effects, with smaller firms benefiting more substantially than larger ones.

The Global Investment Competitiveness Report is based in part on a survey of 2,400 business executives representing FDI in 10 large developing countries (World Bank 2020). It concludes that government actions—such as reducing investor risk and increasing policy predictability—can rebuild investor confidence, based on the report’s new global database of regulatory risk. For aspects of the business environment selected as the biggest obstacle by 169,000 firms in 144 countries, see the World Bank Enterprise Surveys.

The ease of doing business is to some extent measured by the World Bank’s annual Doing Business surveys, which provides objective measures of business regulations for local firms in 190 economies, and ranks economies using aggregate scores on 10 topics. The 2020 DB report illustrates the problem by pointing out that an entrepreneur in a low-income economy typically still spends around 50% of the country’s per-capita income to launch a company, compared with just 4% for an entrepreneur in a high-income economy. It takes nearly six times as long on average to start a business in the economies ranked in the bottom 50 as in the top 20. (World Bank, 2020).

Historically (e.g. 2005-12), the DB initiative and others have written of quantified links between reducing the cost of doing business, and economic growth; correlation did not however prove a causal link for everyone (IFC 2016). More recently, the focus has been on nuanced discussion of the benefits of improved business regulation (see for example World Bank, 2018). There have also been questions about the data; at the end of 2020, the WBG published a review of data irregularities in Doing Business.

There are also questions about the approach: ‘it appears that when strict rules meet weak state capability … the rules bend and become more like individuated “deals”’ (Hallward-Driemeier and Pritchett, 2015). This has influenced a shift for some towards the hybrid approaches referred to in BERF, 2019, combining regulatory approaches with investments.

For a different analytical framework (and country ranking), see the Global Entrepreneurship Monitor, which conducts an annual survey of what it calls Entrepreneurial Framework Conditions (EFC) – which are defined in a way that is close to the wider definition of investment climate. See for example the Economy Profiles in the GEM 2019/2020 Global Report.

For a discussion of ‘what works’ in business environment reform, see BERF 2017.

Note that assessing the investment climate (broadly defined) relies on both subjective and contextual factors; the judgement call is essentially whether the risks are justified by the possible returns. It is therefore an art as much as a science.

Infrastructure is generally taken to include roads, water distribution, mass transportation, airports and utilities; energy supply is therefore part of infrastructure. Productive sectors such as agriculture and manufacturing rely on infrastructure, and many studies have shown a link between investment in infrastructure, and economic growth (e.g. Whittle 2009).

Infrastructure development requires rather specific skills, not usually found in a PSD advisor. For example, public-private partnerships to encourage private investment in infrastructure (e.g. World Bank 2019) have to cover rather specific aspects like upkeep and ownership of the assets. Furthermore, the optimal sequencing of infrastructure investments depends on local circumstances.

Business services have traditionally been provided by development agencies, particularly training in management entrepreneurship skills. Donors have been interested in how to deliver these services sustainably (e.g. DCED 2001), but others increasingly focus on accelerating small and growing businesses (e.g. ANDE). These communities of practice have not yet explicitly linked their offer to the investment climate.

The legal, regulatory and administrative features of the investment climate are often referred to as the business environment. They would also cover the ability of the government to finance investment climate improvements through a healthy tax base, and the quality of public finance management more generally. This topic is too large to be addressed adequately here.

Public-private dialogue (PPD) is a long-term process that has certain pre-conditions:

- the will of government to reform,

- the capacity of national private sector to contribute to the reform process

- and the ability of both public and private sectors to agree on the definition of their respective roles (EC 2019)

For a full set of documents needed to set up a project to promote PPD ‘to improve the business climate’ (training manual, sample MoUs, ToRs etc.), see the dedicated PPD website of WBG/DFID/OECD. For a recent review of the quality of PPD and PSE in a COVID-19 world, see GPEDC 2020. For an example Handbook, taking the case of Jordan, see Brew and Mansur for GIZ, 2020.

In terms of linking BER and investment facilitation, one review of the evidence for effectiveness considered 129 studies, and found no evidence directly addressing the research question. However, 11 studies provided evidence of elements that contributed to this link (DFID 2015).

Some argue that Industrial Policy is the only policy that has delivered growth; others that it has almost never worked. Sometimes, the same evidence is cited in support of both arguments. Furthermore, there is an ongoing debate over which, if any, sectors Industrial Policy should target. Not all industries are equally useful for development, some can be good for mass employment, but allow little technological learning.

Industrial Policy is a relatively demanding approach. To be effective, its design and implementation needs to take into account both a government’s capabilities and political will. (DCED 2017) For more references and reading, visit the DCED Knowledge page on Industrial Policy.

Put another way, ‘industrial policy, if one could implement it well, would accelerate growth but … most countries, and especially those that most need growth, lack the wherewithal for policy implementation.’ (Hallward-Driemeier and Pritchett, 2015).

Recently discussion has shifted from industrial policy to economic transformation; see the dedicated ODI website for more information on application of the term. In particular, see McMillan et al 2017 for a definition, and consideration of the results so far.

The most recent Global Competitiveness report (WEF 2020)(not to be confused with the Global Investment Competitiveness Report of the World Bank 2020) focuses on current trends during the pandemic, notably reviving and transforming the enabling environment, human capital, markets and the innovation ecosystem. The report proposes a basket of indicators that together point to ‘transformation readiness’, based on the findings of the WEF Executive Opinion Survey.

The contribution of tax regimes to competitiveness is a large topic, but some papers focusing on this can be found on the DCED website.

For a discussion of methodological issues and definition of Special Economic Zones, see UNCTAD 2019. For an overview of the global SEZ landscape, and advice on how to respond to fundamental challenges for zones posed by the sustainable development imperative, the new industrial revolution and changing patterns of international production, see the World Investment Report (UNCTAD 2019).

For a recent publication on Increasing the Development Impact of Investment Promotion Agencies, see the Global Investment Competitiveness Report 2019-2020 (World Bank 2020), Chapter 5.

For a recent review of best practices in export promotion activities based in the European Union, see EESC 2018. For a review of the performance of EPAs worldwide, see the What Works Centre for Local Economic Growth 2018.

4.4 Design, manage and evaluate programmes for investment climate reform that:

- improve conditions for and increase domestic and foreign investment;

- provide opportunities for poor people to access and benefit from improved investment opportunities; and

- take account of the differential impacts on men, women and other groups

A rapid assessment of the impact of BER on investment promotion and facilitation (DFID, 2015a) identified fourteen studies showing that BER increased investment at firm-level, leading to increased profit, value added and revenue. Smaller firms benefitted more than large firms. Studies highlighted the particular impact of the regulatory framework for business entry and of tax reform on firm investment. Beyond the firm-level effect of BER, it was however difficult to demonstrate a connection between increased firm investment and broader economic impacts.

Another DFID-funded study (LASER, 2015) reviews evidence on the linkages between investment climate reform and economic growth more broadly; it also cites study stating linking better investment climates, as measured by the World Bank’s Doing Business Indicators, with higher FDI flows.

A rapid assessment of the evidence of direct impact of BER on poverty considered 176 studies, and found that BER does contribute to poverty reduction, but through indirect links rather than directly. The paper explores these indirect effects in detail (DFID, 2015b).

For a detailed review of the links between BER and gender, see DCED 2016. For more Papers on this theme, see WEE and the Business Environment and Integrating gender considerations into BER programming on the DCED website.

Current debates

- Supporters of BER argue that regulating markets effectively should be the highest priority; selecting targets for active intervention risks trying to ‘pick winners’, which is not always successful. Others argue that effective regulation is necessary but not sufficient; active intervention may be needed. In particular, selecting sectors to focus on can be transformative.

- Many developing countries have a substantial informal economy, comprising businesses that are to varying degrees not compliant with all laws. Opinions vary on solutions: streamline the law, improve incentives to formalise, make compliance easier, or enforce compliance more effectively?

- Reforms may be led by individual champions within Government; should development agencies support individual champions or focus on institutions?

Despite these debates, BER remains a priority in most donor agency Private Sector Development Policies and effective practices continue to be widely studied.

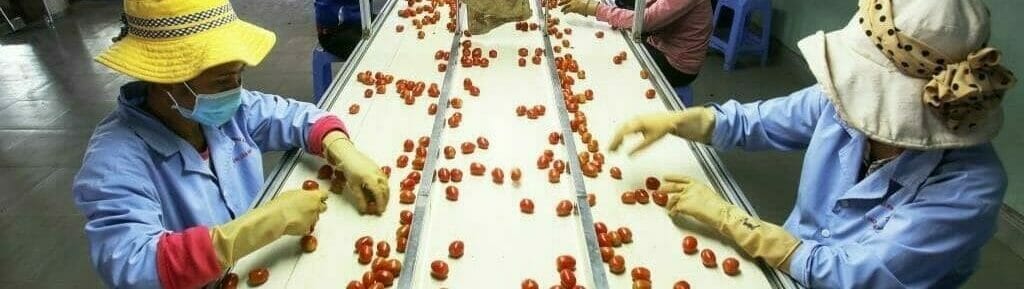

Photo Credit: Foreign, Commonwealth and Development Office/ flickr.com; Global Affairs Canada